[ABF, ACF, ACOF, ACS, ADGF, AEIF, AFIS, AGBF, AGREIF, TAP, AGRAF, AHIF, AInstF, ALCGF, AMIF, AMIF II, ARVF, ASGTF, ASITF, ABT, AUBF, AVP, SCB II, Bernstein, SCB and Income Portfolio

High Yield Portfolio

International Portfolio

International Value Portfolio

Large Cap Growth Portfolio

Money Market Portfolio

Real Estate Investment Portfolio

Small Cap Growth Portfolio

Small/Mid Cap Value Portfolio

Total Return Portfolio

Utility Income Portfolio

U.S. Government/High Grade Securities Portfolio

U.S. Large Cap Blended Style Portfolio

Value Portfolio

Wealth Appreciation Strategy Portfolio

Worldwide Privatization Portfolio

AMMAF are each a "Company."]

| 10 |

PROXYSTATEMENT

AB FUNDS, SCB FUNDS AND ABMulti-Manager Alternative Fund

1345 Avenue of the Americas

New York, New York 10105

-----------------

ANNUAL

JOINT MEETING OF STOCKHOLDERS

November 15, 2005

-----------------

SHAREHOLDERS

October 11, 2018

INTRODUCTION

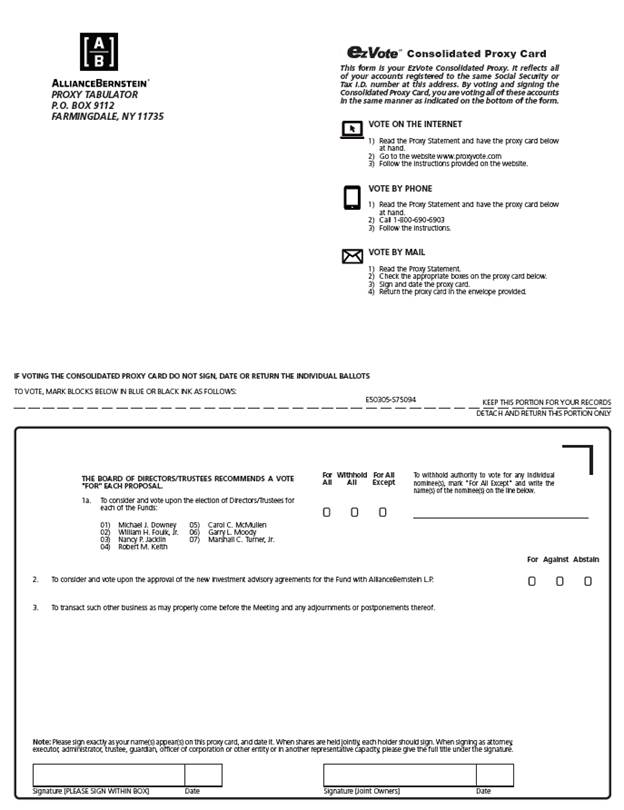

This is a combined Proxy Statement for the portfoliosFunds listed in the accompanying Notice of the

AllianceBernstein Variable Products Series Fund, Inc. (the "Fund") listed aboveJoint Meeting of Shareholders (each a "Portfolio""Fund", and collectively, the "Portfolios""Funds"). The BoardEach of Directors ("Board"the Boards of Directors/Trustees (each a "Board" and collectively, the "Boards") is soliciting proxies for an Annuala Joint Meeting of StockholdersShareholders of each Fund (the "Meeting") to consider and vote on Proposalsproposals that are being recommended by that Board for the Board.

Fund or Funds that is oversees. We refer to Directors or Trustees as, individually, a "Director" or collectively, the "Directors" for the purposes of this Proxy Statement.

The Board isFunds are sending you this Proxy Statement to ask for your vote on several Proposalsthe proposal or proposals affecting your Portfolio.Fund. The PortfoliosFunds will hold the Meeting at the offices of the Fund,Funds, 1345 Avenue of the Americas, 39th41st Floor, New York, New York 10105, on November 15, 2005October 11, 2018 at 3:00 p.m.11:30 a.m., Eastern Time.The solicitation will be made primarily by mail and may also be made by telephone.

The solicitation cost will be borne bytelephone or through the Portfolios. Alliance Capital

ManagementInternet.It is expected that AllianceBernstein L.P. is, the investment adviser to the Portfolios ("Alliance"Funds (the "Adviser")., will bear the expenses of the printing and mailing of the proxy statements relating to the transactions arising from the Plan (as defined below), including the proxy solicitation costs, as well as the legal costs of Fund counsel relating thereto. The Notice of AnnualJoint Meeting of StockholdersShareholders, Proxy Statement, and Proxy Card are beingmailed to stockholders on or about September 29, 2005.

August 20, 2018.

Any stockholder of recordor shareholder (each, a "stockholder" and together, the "stockholders") who owned shares of a Portfolio as ofFund at the close of business on August 24, 200513, 2018 (the "Record Date") is entitled to notice of, and to vote at, the Meeting and any postponement or adjournment thereof. Each share is entitled to one vote.

1

SharesAppendix A sets forth the number of the Portfolios are not sold directly to individuals. The

Portfolios only offer their shares through the separate accounts of life

insurance companies ("Insurers"). Contractholders select a Portfolio as an

investment option through an insurance contract with the Insurer. The Insurer

that uses a Portfolio as a funding vehicle is, in most cases, the legal

stockholder of the Portfolio and, as such, has voting and investment power with

respect to the shares. However, the Insurer generally will pass through any

voting rights to contractholders and will vote the shares of each Portfolio inFund issued and outstanding as of the manner directed byRecord Date. The Joint Meeting of Shareholders is designated as (i) the "Annual" shareholder meeting for all AB Funds (except for Alliance California Municipal Income Fund, Inc., AllianceBernstein Global High Income Fund, Inc. and AllianceBernstein National Municipal Income Fund, Inc.) and all SCB Funds and (ii) a contractholder. With respect"Special" shareholder meeting for all other Funds.

Important Notice Regarding Availability of Proxy Materials for the Shareholders' Meeting to shares for which a

contractholder fails to provide voting instructions, or shares that the Insurer

holds for its own benefit (i.e., rather thanbe Held on behalf of a contractholder),

the Insurers will vote such shares in the same proportion as the shares for

which voting instructions were received from contractholders. For proxies

received with no voting instructions on how to vote, the Insurer will vote

those shares "FOR" the proposals.

We have divided theThursday, October 11, 2018. This Proxy Statement into five main parts:

Part I - Overview of the Board's Proposals.

Part II - Discussionof each Proposal and an explanation of why we are requesting that you approve each

Proposal.

Part III - Informationabout the Portfolios' independent registered public accounting firm.

Part IV - Additionalinformationis available on proxy voting and stockholder meetings.

Part V - Otherinformation about the Fund and the Portfolios.

2

Part I - Overview of Proposals

As a stockholder of one or more of the Portfolios, you are being asked to

consider and vote on a number of Proposals. While the following list is long,

not all of the Proposals apply to each Portfolio. Many of the Proposals relate

to conforming changes that will result in standardized policies across the

Portfolios.

Internet at www.alliancebernstein.com/abfundsproxy.

| 11 |

PROPOSAL ONE

ELECTION OF DIRECTORS

At the Meeting, stockholders of each Fund, except for ACMIF, AGHIF and ANMIF, will vote on the election of Directors of thetheir Fund. Each[1]Unless otherwise noted herein, each Director elected at the Meeting will serve for a term of an indefinite duration and until his or her successor is duly elected and qualifies.

The following individuals identified below have been nominated for election as Directors of the Funds as indicated below. The nominees for each Fund, except for AMMAF, are all current members of their respective Boards.

Section 16 of the 1940 Act requires that fund directors must be elected by the holders of outstanding securities of a fund, with the exception that vacancies occurring between meetings may be filled in any otherwise legal manner so long as, immediately after a vacancy is filled, at least two-thirds of the directors were elected by security holders. In order to provide the Boards with the maximum flexibility to fill vacancies on the Board without the administrative burden and expense of calling a special meeting of stockholders, the Board of each Fund (except for AMMAF) believes it is appropriate for all current Directors to be submitted to stockholders for election.

For Funds other than SCB, Bernstein and AMMAF, each nominee was recommended for nomination by the Fund's Governance and Nominating Committee; for SCB and Bernstein, each nominee was recommended for nomination by the Fund's Governance, Nominating and Compensation Committee ("Governance Committee"). Each of these Committees, which, among other things, considers recommendations on nominations for Directors, reviewed the qualifications, experience, and background of the nominees. Based upon this review, each Committee recommended each nominee to the respective Board as a candidate for nomination as a Director. ItAt meetings of Directors held on July 26, 2018 (SCB and Bernstein) and July 31-August 2, 2018 (Funds other than SCB, Bernstein and AMMAF), after discussion and further consideration of the matter, the Directors voted to nominate the nominees for election by shareholders.

Stockholders of AMMAF are being asked to elect new nominees as Directors. Currently, there are four Directors on the AMMAF Board, all of whom were elected by the Fund's initial stockholder before the Fund was offered publicly. Two of the current Directors (Mr. Carter F. "Terry" Wolfe, who is approaching the retirement age set by the AMMAF Board, and Mr. Christopher J. Bricker, whose role at the Adviser has changed) have expressed a desire to retire as Directors. The vacancies created by their retirement, however, could not both be filled by the AMMAF Board without AMMAF holding a meeting of stockholders. For the reasons discussed in more detail below, the Adviser recommended that, rather than the Board nominating two new Directors for election to the current AMMAF Board, the Board nominate the members of the Bernstein Board to serve as the Directors of AMMAF. This recommendation was based, in part, on the fact that the Bernstein Board oversees other registered investment companies primarily offered to clients of the Adviser's Bernstein Private Wealth Management division, which is the same distribution channel used for AMMAF.

______________

[1]ACMIF, AGHIF and ANMIF are closed-end funds and hold annual stockholder meetings for the purpose of electing Directors. All of the current Directors of these Funds have been previously elected by stockholders.

When AMMAF commenced operations in 2012, it was expected that AMMAF would be offered and sold to Bernstein private clients and through unaffiliated dealers through the Adviser's normal distribution channels. However, AMMAF has not been and is not being sold through unaffiliated dealers, and the Adviser has no current intention of offering AMMAF other than to private clients. Accordingly, the Adviser stated its belief that there may be efficiencies gained by having oversight of AMMAF vested in the Bernstein Board, which oversees other funds primarily intended for distribution to private clients. For example, the consolidation of AMMAF under the oversight of the Bernstein Board is expected to result in reductions in certain fund expenses, including director fees and expenses, insurance, counsel fees, administrative reimbursement costs and other operational expenses. An analysis comparing the expenses currently incurred by AMMAF with a pro forma estimate of expenses after the election of new directors assuming AMMAF was included in the SCB Fund complex was reviewed by the AMMAF Board. In addition, the Adviser reported that a single Board for both AMMAF and the SCB Funds may facilitate oversight of the Funds' service providers, a number of whom provide services to both AMMAF and the SCB Funds.

In addition to considering the Adviser's recommendation, AMMAF's Governance and Nominating Committee reviewed the qualifications, experience, and background of the nominees. Based upon this review, the Governance and Nominating Committee nominated each member of the Bernstein Board as a candidate for nomination as an Independent Director for AMMAF. At a meeting of Directors of AMMAF held on July 24, 2018, after discussion and further consideration of the matter, the Board voted to nominate the nominees for election by stockholders.

Unless contrary instructions are received, it is the intention of the persons named as proxies in the accompanying Proxy Card to vote in favor of the nominees named below for election as Director of the Fund.

Ms. Ruth Block

Mr. David H. Dievler

Mr. John H. Dobkin

Mr. Michael J. Downey

Mr. William H. Foulk, Jr.

Mr. D. James Guzy

Mr. Marc O. Mayer

Mr. Marshall C. Turner, Jr.

Directors.

| All Funds Other Than SCB, Bernstein and AMMAF | SCB, Bernstein and AMMAF | |

| Michael J. Downey | Kathleen Fisher | |

| William H. Foulk, Jr. | Bart Friedman | |

| Nancy P. Jacklin | R. Jay Gerken | |

| Robert M. Keith | William Kristol | |

| Carol C. McMullen | Debra Perry | |

| Garry L. Moody | Donald K. Peterson | |

| Marshall C. Turner, Jr. | ||

| Earl D. Weiner | ||

Each nominee has consented to serve as a Director. The Board knowsBoards of the Funds electing Directors know of no reason why any of the nominees would be unable to serve, but in the event any nominee is unable to serve or for good cause will not serve, the proxies received indicating a vote in favor of such nominee will be voted for a substitute nominee as the BoardBoards may recommend. The Fund has a policy generally

requiring that Directors retire at the end of the calendar yeardetermine, in which they

reach the age of 76. The Governanceits sole and Nominating Committee and the Board have

waived the application of this policy to Mr. Dievler through December 31, 2006.

absolute discretion.

Certain information concerningthe Funds' nominees for Director is set forth below.

below (nominees are referred to as Directors in the charts below).

| 2 |

All Funds (Other Than SCB, Bernstein and AMMAF)

NAME, ADDRESS,* (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHER INFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

INDEPENDENT DIRECTORS | |||

Marshall C. Turner, Jr.# Chairman of 76 (1992) | Private Investor since |

| 94 | Xilinx, Inc. (programmable logic semi-conductors) since 2007 | ||

Michael J. Downey,# (2005) | Private Investor since |

| 94 | The Asia Pacific Fund, Inc. (registered investment company) since |

| 3 |

NAME, ADDRESS,* (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHER INFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

William H. Foulk, Jr., 85 (1990) | Investment Adviser and an Independent Consultant since prior to 2013. Previously, he was | 94 | None |

Nancy P. Jacklin,# 70 (2006) | Private Investor since prior to 2013. Professorial Lecturer at the Johns Hopkins School of Advanced International Studies (2008-2015). U.S. Executive Director of the International Monetary Fund (which is responsible for ensuring the stability of the international monetary system), (December 2002-May 2006); Partner, Clifford Chance (1992-2002); Sector Counsel, International Banking and Finance, and Associate General Counsel, Citicorp (1985-1992); Assistant General Counsel (International), Federal Reserve Board of | 94 | None |

| 4 |

NAME, ADDRESS,* (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHER INFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR |

Carol C. McMullen,# 62 (2016) | Managing Director of Slalom Consulting (consulting) since 2014, private investor and member of the Partners Healthcare Investment Committee. Formerly, Director of Norfolk & Dedham Group (mutual property and casualty insurance) from 2011 until November 2016; Director of Partners Community Physicians Organization (healthcare) from 2014 until December 2016; and Managing Director of The Crossland Group (consulting) from 2012 until 2013. She has held a number of senior positions in the asset and wealth management industries, including at Eastern Bank (where her roles included President of Eastern Wealth Management), Thomson Financial (Global Head of Sales for Investment Management), and Putnam Investments (where her roles included Head of Global Investment Research). She has served on a number of private company and non-profit boards, and as a director or trustee of the AB Funds since June 2016. | 94 | None |

Garry L. Moody,# 66 (2007) | Independent Consultant. Formerly, Partner, Deloitte & Touche LLP (1995-2008) where he held a number of senior positions, including Vice Chairman, and U.S. and Global Investment Management Practice Managing Partner; President, Fidelity Accounting and Custody Services Company (1993-1995), where he was responsible for accounting, pricing, custody and reporting for the Fidelity mutual funds; and Partner, Ernst & Young LLP (1975-1993), where he served as the National Director of Mutual Fund Tax Services and Managing Partner of its Chicago Office Tax department. He is a member of the Trustee Advisory Board of BoardIQ, a biweekly publication focused on issues and news affecting directors of mutual funds. He has served as a director or trustee, and as Chairman of the Audit Committees, of the AB Funds since 2008. | 94 | None |

| 5 |

NAME, ADDRESS,* (YEAR FIRST ELECTED**) | PRINCIPAL OCCUPATION(S) DURING PAST FIVE YEARS AND OTHER INFORMATION | PORTFOLIOS IN AB FUND COMPLEX OVERSEEN BY DIRECTOR | OTHER PUBLIC COMPANY DIRECTORSHIPS CURRENTLY HELD BY DIRECTOR | |

Earl D. Weiner,# 78 (2007) | Of Counsel, and Partner prior to January 2007, of the law firm Sullivan & Cromwell LLP and is a former member of the ABA Federal Regulation of Securities Committee Task Force to draft editions of the Fund Director's Guidebook. He also serves as a director or trustee of various non-profit organizations and has served as Chairman or Vice Chairman of a number of them. He has served as a director or trustee of the AB Funds since 2007 and served as Chairman of the Governance and Nominating Committees of the AB Funds from 2007 until August 2014. | 94 | None | |

| INTERESTED DIRECTOR | ||||

Robert M. Keith,+ 58 (2009) | Senior Vice President of the Adviser++ and the head of AllianceBernstein Investments, Inc. | 94 | None | |

| ___________________________________________________ |

| * | The address for each of the |

| ** | There is no stated term of |

| # | Member of the Audit Committee, the Governance and |

+ Mr. Dievler, the Governance and Nominating Committee

and the Board of the Fund have waived the application of this retirement

policy through December 31, 2006.

***Mr. MayerKeith is an "interested person", as defined in Section 2(a)(19) of the 1940 Act, of the Fund

due toFunds because of his position as Executive Vice President of ACMC.

As of August 17, 2005,affiliation with the Adviser.

| ++ | The Adviser and ABI are affiliates of the Funds. |

| 6 |

In addition to the knowledge of management,public company directorships currently held by the Directors of the AB Funds, set forth in the table above, Mr. Turner was a director of SunEdison, Inc. (solar materials and officerspower plants) since prior to 2013 until July 2014, Mr. Downey was a director of The Merger Fund (a registered investment company) from 1995 until 2013, and Mr. Moody was a director of Greenbacker Renewable Energy Company LLC (renewable energy and energy efficiency projects) from August 2013 until January 2014.

Directors who are not "interested persons" of the Fund both individuallyas defined in the 1940 Act, are referred to as "Independent Directors", and Directors who are "interested persons" of the Fund are referred to as "Interested Directors".

SCB, Bernstein and AMMAF

| NAME, ADDRESS,* AGE, (YEAR ELECTED**) | PRINCIPAL THE PAST FIVE YEARS INFORMATION | NUMBER OF PORTFOLIOS IN THE FUND COMPLEX OVERSEEN BY THE DIRECTOR | OTHER DIRECTORSHIPS THE DIRECTOR DURING |

| INTERESTED DIRECTOR*** | |||

Kathleen Fisher*** c/o AllianceBernstein L.P. 1345 Avenue of the Americas New York, NY 10105 64 (SCB Fund: 2017) (Bernstein Fund: 2017) | Senior Vice President of the Adviser with which she has been associated since prior to 2013. She is the Head of Wealth and Investment Strategies of the Adviser's Bernstein Private Wealth Management unit since 2014, leading the team responsible for developing and communicating asset allocation advice and investment strategies for Bernstein's high-net-worth clients. Since 2013, Ms. Fisher has overseen research on investment planning and wealth transfer issues facing high-net-worth families, endowments and foundations. She has been a National Managing Director of Bernstein since 2009. She joined AB in 2001 as a Senior Portfolio Manager. Prior to joining AB, she spent 15 years at J.P. Morgan, most recently as a managing director advising banks on acquisitions, divestitures and financing techniques. Prior thereto, she held positions at both Morgan Stanley and at the Federal Reserve Bank of New York. | 18 | Southwestern Vermont Health Care; and Hildene—The Lincoln Family Home |

| 7 |

| NAME, ADDRESS,* AGE, (YEAR ELECTED**) | PRINCIPAL THE PAST FIVE YEARS INFORMATION | NUMBER OF PORTFOLIOS IN THE FUND COMPLEX OVERSEEN BY THE DIRECTOR | OTHER DIRECTORSHIPS THE DIRECTOR DURING |

| INDEPENDENT DIRECTORS*** | |||

Debra Perry#^ Chairman of the Board of SCB and Bernstein 67 (SCB Fund: 2011) (Bernstein Fund: 2015) | Formerly, Senior Managing Director of Global Ratings and Research, Moody's Investors Service, Inc. (securities rating agency) from 2001 to 2004; Chief Administrative Officer, Moody's, from 1999 to 2001; Chief Credit Officer, Moody's, from 2000 to 2001; Group Managing Director for the Finance, Securities and Insurance Ratings Groups, Moody's Corp., from 1996 to 1999; Earlier she held executive positions with First Boston Corporation and Chemical Bank. | 18 | Assurant, Inc. (2017 – present); Genworth Financial, Inc. (2016 – present); Korn/Ferry International (2008 – present); PartnerRe, from 2013-2016; Bank of America Funds Series Trust, from 2011-2016 |

R. Jay Gerken# 67 (SCB Fund: 2013) (Bernstein Fund: 2015) | Formerly, President and Chief Executive Officer of Legg Mason Partners Fund Advisor, LLC (investment adviser), and President & Board Member of The Legg Mason and Western Asset mutual funds from 2005 until June 2013. Previously, he was the President and Chair of the funds boards of the Citigroup Asset Management mutual funds from 2002 to 2005; Portfolio Manager and Managing Director, Smith Barney Asset Management from 1993 to 2001 and President & CEO, Directions Management of Shearson Lehman, Inc. from 1988 to 1993. | 18 | Cedar Lawn Corporation; Trustee of the New Jersey Chapter of The Nature Conservancy; Trustee of the United Methodist Foundation of New Jersey; and Associated Banc-Corp |

William Kristol# 65 (SCB Fund: 1994) (Bernstein Fund: 2015) | Editor,The Weekly Standard since prior to 2013. He is a regular contributor on ABC'sThis Week and on ABC's special events and elections coverage, and appears frequently on other political commentary shows. | 18 | Manhattan Institute; John M. Ashbrook Center for Public Affairs at Ashland University; The Salvatori Center at Claremont McKenna College; The Shalem Foundation; The Institute for the Study of War; and Defending Democracy Together |

| 8 |

| NAME, ADDRESS,* AGE, (YEAR ELECTED**) | PRINCIPAL THE PAST FIVE YEARS INFORMATION | NUMBER OF PORTFOLIOS IN THE FUND COMPLEX OVERSEEN BY THE DIRECTOR | OTHER DIRECTORSHIPS THE DIRECTOR DURING |

Bart Friedman# 73 (SCB Fund: 2005) (Bernstein Fund: 2015) | Senior Partner at Cahill Gordon & Reindel LLP (law firm) since prior to 2013 (currently Senior Counsel). | 18 | Chair of the Audit Committee of The Brookings Institution; Chair of the Audit and Compensation Committees of Lincoln Center for the Performing Arts; and Ovid Therapeutics, Inc. |

Donald K. Peterson#^ 68 (SCB Fund: 2007) (Bernstein Fund: 2015) | Formerly, Chairman and Chief Executive Officer, Avaya Inc. from 2002 to 2006; President and Chief Executive Officer, Avaya Inc. (telecommunications equipment and services) from 2000 to 2001; President, Enterprise Systems Group in 2000; Chief Financial Officer, Lucent Technologies (telecommunications equipment and services) from 1996 to 2000; Chief Financial Officer, AT&T, Communications Services Group from 1995 to 1996; President, Nortel Communications Systems, Inc. from 1994 to 1995; Prior thereto he was at Nortel from 1976 to 1995. | 18 | Worcester Polytechnic Institute (Emeritus); Member of the Board of TIAA-CREF; and Member of the Board of TIAA-CREF Bank, FSB |

| * | The address for each of SCB/Bernstein Fund's Independent Directors is c/o AllianceBernstein L.P., Attn: Legal & Compliance Department – Mutual Fund Legal, 1345 Avenue of the Americas, New York, NY 10105. |

| ** | There is no stated term of office for each SCB/Bernstein Fund's Directors. |

| *** | Ms. Fisher is an "interested person," as defined in the 1940 Act, because of her affiliation with the Adviser. |

| # | Member of each SCB/Bernstein Fund's Audit Committee and Independent Directors Committee and Governance, Nominating and Compensation Committee. |

| ^ | Member of each SCB/Bernstein Fund's Fair Value Pricing Committee. |

| 9 |

The business affairs of each SCB Fund are managed under the oversight of the Bernstein Board. Directors who are not "interested persons" of each SCB Fund, as defined in the 1940 Act, are referred to as "Independent Directors," and Directors who are "interested persons" of each SCB Fund are referred to as "Interested Directors." Certain information concerning each SCB Fund's governance structure and each Director is set forth below.

All Funds (Other Than SCB, Bernstein and AMMAF)

Experience, Skills, Attributes, and Qualifications of the Funds' Directors. The Governance and Nominating Committee of each Fund's Board, which is composed of Independent Directors, reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board, and conducts a similar review in connection with the proposed nomination of current Directors for re-election by stockholders at any annual or special meeting of stockholders. In evaluating a candidate for nomination or election as a group, owned less than 1%Director the Governance and Nominating Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Governance and Nominating Committee believes contributes to good governance for the Fund. Additional information concerning the Governance and Nominating Committee's consideration of nominees appears in the description of the sharesCommittee below.

Each Fund's Board believes that, collectively, the Directors have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing the Fund and protecting the interests of stockholders. The Board of each Fund has concluded that, based on each Director's experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Directors, each Director is qualified and should continue to serve as such.

In determining that a particular Director was and continues to be qualified to serve as a Director, the Board has considered a variety of criteria, none of which, in isolation, was controlling. In addition, the Board has taken into account the actual service and commitment of each Director during his or her tenure (including the Director's commitment and participation in Board and committee meetings, as well as his or her current and prior leadership of standing and ad hoc committees) in concluding that each should continue to serve. Additional information about the specific experience, skills, attributes and qualifications of each Director, which in each case led to the Board's conclusion that the Director should serve (or continue to serve) as trustee or director of the Fund, is provided in the table above and in the next paragraph.

| 1 |

Among other attributes and qualifications common to all Directors are their ability to review critically, evaluate, question and discuss information provided to them (including information requested by the Directors), to interact effectively with the Adviser, other service providers, counsel and the Fund's independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Directors. In addition to his or her service as a Director of the Fund and each respective Portfolio. Additional information

related toother AB Funds as noted in the equity ownershiptable above: Mr. Downey has experience in the investment advisory business including as Chairman and Chief Executive Officer of a large fund complex and as director of a number of non-AB funds and as Chairman of a non-AB closed-end fund; Mr. Foulk has experience in the investment advisory and securities businesses, including as Deputy Comptroller and Chief Investment Officer of the State of New York (where his responsibilities included bond issuances, cash management and oversight of the New York Common Retirement Fund), has served as Chairman of the Independent Directors Committees from 2003 until early February 2014, served as Chairman of the AB Funds from 2003 through December 2013, and is active in a number of mutual fund related organizations and committees; Ms. Jacklin has experience as a financial services regulator as U.S. Executive Director of the International Monetary Fund (which is responsible for ensuring the stability of the international monetary system), and as a financial services lawyer in private practice and has served as Chair of the Governance and Nominating Committees of the AB Funds since August 2014; Mr. Keith has experience as an executive of the Adviser with responsibility for, among other things, the AB Funds; Ms. McMullen has experience as a management consultant and as a director of various private companies and nonprofit organizations, as well as extensive asset management experience at a number of companies, including as an executive in the areas of portfolio management, research, and sales and marketing; Mr. Moody has experience as a certified public accountant including experience as Vice Chairman and U.S. and Global Investment Management Practice Partner for a major accounting firm, is a member of both the governing council of an organization of independent directors of mutual funds and the compensation they

received from the Fund is presented in Appendix B. During the Fund's most

recently completed fiscal year, the DirectorsTrustee Advisory Board of BoardIQ, a biweekly publication focused on issues and news affecting directors of mutual funds, and has served as a group did not engage in the

purchasedirector or sale of more than 1% of any class of securities of Alliance or of

any of its parents or subsidiaries.

During the Fund's fiscal year ended in 2004, the Board met 12 times. Each

Director attended at least 75%trustee and Chairman of the totalAudit Committees of the AB Funds since 2008; Mr. Turner has experience as a director (including Chairman and Chief Executive Officer of a number of meetingscompanies) and as a venture capital investor including prior service as general partner of three institutional venture capital partnerships, and has served as Chairman of the AB Funds since January 2014 and Chairman of the Independent Directors Committees of such AB Funds since February 2014; and Mr. Weiner has experience as a securities lawyer whose practice includes registered investment companies and as director or trustee of various non-profit organizations and served as Chairman or Vice Chairman of a number of them, and served as Chairman of the Governance and Nominating Committees of the AB Funds from 2007 until August 2014. The disclosure herein of a director's experience, qualifications, attributes and skills does not impose on such director any duties, obligations, or liability that are greater than the duties, obligations and liability imposed on such director as a member of the Board held duringand any committee thereof in the fiscal yearabsence of such experience, qualifications, attributes and ifskills.

| 2 |

Board Structure and Oversight Function. The Board is responsible for oversight of that Fund. Each Fund has engaged the Adviser to manage the Fund on a member, at least 75%day-to-day basis. The Board is responsible for overseeing the Adviser and the Fund's other service providers in the operations of that Fund in accordance with the Fund's investment objective and policies and otherwise in accordance with its prospectus, the requirements of the total1940 Act and other applicable Federal, state and other securities and other laws, and the Fund's charter and bylaws. The Board typically meets in-person at regularly scheduled meetings four times throughout the year. In addition, the Directors may meet in person or by telephone at special meetings or on an informal basis at other times. The Independent Directors also regularly meet without the presence of any representatives of management. As described below, the Board has established three standing committees – the Audit, Governance and Nominating, and Independent Directors Committees – and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. Each committee is composed exclusively of Independent Directors. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

An Independent Director serves as Chairman of the Board. The Chairman's duties include setting the agenda for each Board meeting in consultation with management, presiding at each Board meeting, meeting with management between Board meetings, and facilitating communication and coordination between the Independent Directors and management. The Directors have determined that a Board's leadership by an Independent Director and its committees composed exclusively of Independent Directors is appropriate because they believe it sets the proper tone to the relationships between the Fund, on the one hand, and the Adviser and other service providers, on the other, and facilitates the exercise of the Board's independent judgment in evaluating and managing the relationships. In addition, each Fund is required to have an Independent Director as Chairman pursuant to certain 2003 regulatory settlements involving the Adviser.

Risk Oversight. Each Fund is subject to a number of meetingsrisks, including investment, compliance and operational risks, including cyber risks. Day-to-day risk management with respect to a Fund resides with the Adviser or other service providers (depending on the nature of the committees held duringrisk), subject to supervision by the period for which he or she

served. The Fund does not have a policy that requires a Director to attend

annual meetings of stockholders but the Fund encourages such attendance.Adviser. The Board has fourcharged the Adviser and its affiliates with (i) identifying events or circumstances the occurrence of which could have demonstrable and material adverse effects on the Fund; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of a Board's general oversight of the Fund's investment program and operations and is addressed as part of various regular Board and committee activities. The Fund's investment management and business affairs are carried out by or through the Adviser and other service providers. Each of these persons has an independent interest in risk management but the policies and the methods by which one or more risk management functions are carried out may differ from the Fund's and each other's in the setting of priorities, the resources available or the effectiveness of relevant controls. Oversight of risk management is provided by the Board and the Audit Committee. The Directors regularly receive reports from, among others, management (including the Chief Risk Officer of the Adviser), the Fund's Chief Compliance Officer, the Fund's independent registered public accounting firm, the Adviser's internal legal counsel, the Adviser's Chief Compliance Officer and internal auditors for the Adviser, as appropriate, regarding risks faced by the Fund and the Adviser's risk management programs. In addition, the Directors receive regular updates on cyber security matters from the Adviser.

| 3 |

Not all risks that may affect a Fund can be identified, nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost-effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Fund or the Adviser, its affiliates or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve a Fund's goals. As a result of the foregoing and other factors a Fund's ability to manage risk is subject to substantial limitations.

Board Committees. Each Fund's Board has three standing committees:committees – an Audit Committee, a Governance and Nominating Committee and an Independent Directors Committee, and a Fair Value

Pricing Committee. The members of the Fund's committeesAudit, Governance and Nominating and Independent Directors Committees are identified above in

the table listing the Directors. above.

The function of the Audit Committee is to assist the Board in its oversight of theeach Fund's accounting and financial reporting process.policies and practices. The Audit Committee of the Board met twothree times during theeach Fund's most recently completed fiscal year.period.

The function of the Governance and Nominating Committee includes the nomination of persons to fill any vacancies or newly created positions on the Board. The Governance and Nominating Committee of the Board met twothree times during theeach Fund's most recently completed fiscal year. period.

The Board has adopted a charter for its Governance and Nominating Committee, a copy of which is included as Appendix C.Committee. Pursuant to the charter, of the Governance and Nominating Committee, the

Governance and Nominating Committee assists the Board in carrying out its responsibilities with respect to governance of the Fund and identifies, evaluates, and selects and nominates candidates for the Board. The Committee may also may set standards or qualifications for Directors.Directors and reviews at least annually the performance of each Director, taking into account factors such as attendance at meetings, adherence to Board policies, preparation for and participation at meetings, commitment and contribution to the overall work of the Board and its committees, and whether there are health or other reasons that might affect the Director's ability to perform his or her duties. The Committee may consider candidates as Directors submitted by the Fund's current Board members, officers, investment adviser,the Adviser, stockholders and other appropriate sources.

The

Pursuant to the Charter, the Governance and Nominating Committee will consider candidates for nomination as a director submitted by a stockholder or group of stockholders who have beneficially owned at least 5% of the Fund's outstanding common stock or shares of beneficial interest for at least two years prior toat the time of submission and who timely provide specified information about the candidates and the nominating stockholder or group. To be timely for consideration by the Governance and Nominating Committee, the

9

FundFunds not less than 120 days before the date of the proxy statement for the previous year's annual meeting of stockholders or, ifstockholders. If the Funds did not hold an annual meeting was not heldof stockholders in the previous year, all required informationthe submission must be delivered or mailed and received within a reasonable amount of time before the Fund beginsFunds begin to print and mail its proxy materials. Public notice of such upcoming annual meeting of stockholders may be given in a stockholder report or other mailing to stockholders or by other means deemed by the Governance and Nominating Committee or the Board to be reasonably calculated to inform stockholders.

| 4 |

Stockholders submitting a candidate for consideration by the Governance and Nominating Committee must provide the following information to the Governance and Nominating Committee: (i) a statement in writing setting forth (A) the name, date of birth, business address and residence address of the candidate; (B) any position or business relationship of the candidate, currently or within the preceding five years, with the stockholder or an associated person of the stockholder as defined below; (C) the class or series and number of all shares of a Fund owned of record or beneficially by the candidate; (D) any other information regarding the candidate that is required to be disclosed about a nominee in a proxy statement or other filing required to be made in connection with the solicitation of proxies for election of Directors pursuant to Section 20 of the 1940 Act and the rules and regulations promulgated thereunder; (E) whether the stockholder believes that the candidate is or will be an "interested person" of the Funds (as defined in the 1940 Act) and, if believed not to be an "interested person", information regarding the candidate that will be sufficient for the Funds to make such determination; and (F) information as to the candidate's knowledge of the investment company industry, experience as a director or senior officer of public companies, directorships on the boards of other registered investment companies and educational background; (ii) the written and signed consent of the candidate to be named as a nominee and to serve as a Director if elected; (iii) the written and signed agreement of the candidate to complete a directors' and officers' questionnaire if elected; (iv) the stockholder's consent to be named as such by the Funds; (v) the class or series and number of all shares of a Fund owned beneficially and of record by the stockholder and any associated person of the stockholder and the dates on which such shares were acquired, specifying the number of shares owned beneficially but not of record by each, and stating the names of each as they appear on the Funds' record books and the names of any nominee holders for each; and (vi) a description of all arrangements or understandings between the stockholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made by the stockholder. "Associated person of the stockholder" means any person who is required to be identified under clause (vi) of this paragraph and any other person controlling, controlled by or under common control with, directly or indirectly, (a) the stockholder or (b) the associated person of the stockholder.

The Governance and Nominating Committee may require the stockholder to furnish such other information as it may reasonably require or deem necessary to verify any information furnished pursuant to the nominating procedures described above or to determine the qualifications and eligibility of the candidate proposed by the stockholder to serve on the Board. If the stockholder fails to provide such other information in writing within seven days of receipt of written request from the Governance and Nominating Committee, the recommendation of such candidate as a nominee will be deemed not properly submitted for consideration, and will not be considered, by the Committee.

The Governance and Nominating Committee will consider only one candidate submitted by such a stockholder or group for nomination for election at an annual meeting of stockholders. The Governance and Nominating Committee will not consider self-nominated candidates. The Governance and Nominating Committee will consider and evaluate candidates submitted by stockholders on the basis of the same criteria as those used to consider and evaluate candidates submitted from other sources. These criteria include the candidate's relevant knowledge, experience, and expertise, the candidate's ability to carry out his or her duties in the best interests of the FundFunds, and the candidate's ability to qualify as an Independent Director. When assessing a disinterested Director. A

detailed descriptioncandidate for nomination, the Committee considers whether the individual's background, skills, and experience will complement the background, skills, and experience of other nominees and will contribute to the diversity of the criteria used by the Governance and Nominating

Committee as well as information required to be provided by stockholders

submitting candidates for consideration by the Governance and Nominating

Committee are included in Appendix C.

The function of the Fair Value Pricing Committee is to consider, in advance

if possible, any fair valuation decision of Alliance's Valuation Committee

relating to a security held by a Portfolio made under unique or highly unusual

circumstances not previously addressed by the Valuation Committee that would

result in a change in the Portfolio's net asset value ("NAV") by more than

$0.01 per share. The Fair Value Pricing Committee did not meet during the

Fund's most recently completed fiscal year.

Board.

The function of the Independent Directors Committee is to consider and take action on matters that the Board or Committee believes should be addressed in executive session of the disinterestedIndependent Directors, such as review and approval of the Advisory and Distribution Services Agreements. The Independent Directors Committee did not meetof the Board met seven times during theeach Fund's most recently completed fiscal year.

period.

| 5 |

SCB and Bernstein

Experience, Skills, Attributes, and Qualifications of the SCB/Bernstein Fund's Directors. Each SCB/Bernstein Fund's Governance Committee, which is composed of Independent Directors, reviews the experience, qualifications, attributes and skills of potential candidates for nomination or election by the Board, and conducts a similar review in connection with the proposed nomination of current Directors for re-election by stockholders at an annual or special meeting of stockholders. In evaluating a candidate for nomination or election as a Director, the Governance Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Governance Committee believes contributes to good governance for the applicable Fund. Additional information concerning each Governance Committee's consideration of Directors appears in the description of the Committee below.

The Board believes that, collectively, the Directors of SCB/Bernstein Funds have balanced and diverse experience, qualifications, attributes, and skills, which allow the Board to operate effectively in governing each such Fund and protecting the interests of stockholders. Each Board has concluded that, based on each Director's experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Directors, each Director is qualified to serve as such.

In determining that a particular Director was qualified to serve as a Director, the Board considered a variety of criteria, none of which, in isolation, was controlling. In addition, each Board has taken into account the actual service and commitment of each Director during his or her tenure (including the Director's commitment and participation in Board and committee meetings, as well as his or her current and prior leadership of standing committees) in concluding that each should serve as Director. Additional information about the specific experience, skills, attributes and qualifications of each Director, which in each case led to the Board's conclusion that each Director should serve as a Director of the applicable Fund, is provided in the table above and in the next paragraph.

Among other attributes and qualifications common to all Directors of the SCB/Bernstein Funds are their ability to review critically, evaluate, question and discuss information provided to them (including information requested by the Directors), to interact effectively with the Adviser, other service providers, counsel and the applicable Fund's independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Directors. While each Board does not have a formal, written diversity policy, the Board believes that an effective board consists of a diverse group of individuals who bring together a variety of complementary skills and perspectives. In addition to his or her service as a Director of each Fund: Ms. Fisher has business, finance and investment management experience as Head of Wealth and Investment Strategies of Bernstein Private Wealth Management of the Adviser; Mr. Friedman has a legal background and experience as a board member of various organizations; Mr. Gerken has investment management experience as a portfolio manager and executive officer, and experience as a board member; Mr. Kristol has a public and economic policy background and experience as a board member of various organizations; Ms. Perry has business and financial experience as a senior executive of various financial services firms focusing on fixed income research and capital markets and experience as a board member of various organizations; and Mr. Peterson has business and finance experience as an executive officer of public companies and experience as a board member of various organizations. The disclosure herein of a Director's experience, qualifications, attributes and skills does not impose on such Director any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such Director as a member of a Board and any committee thereof in the absence of such experience, qualifications, attributes and skills.

| 6 |

Board Structure and Oversight Function. The Board is responsible for oversight of the applicable SCB/Bernstein Fund. Each such Fund has engaged the Adviser to manage the Funds on a day-to-day basis. Each Board is responsible for overseeing the Adviser and the applicable Fund's other service providers in the operations of the Fund in accordance with the Fund's investment objectives and policies and otherwise in accordance with the Prospectus, the requirements of the 1940 Act, and other applicable Federal, state and other securities and other laws, and each Fund's charter and bylaws. The Board meets in-person at regularly scheduled meetings five times throughout the year. In addition, the Directors may meet in-person or by telephone at special meetings or on an informal basis at other times. The Independent Directors also regularly meet without the presence of any representatives of management. As described below, the Board has established four standing committees—the Audit Committee, the Governance Committee, the Fair Value Pricing Committee and the Independent Directors Committee—and may establish ad hoc committees or working groups from time to time, to assist the Board in fulfilling its oversight responsibilities. Each committee is composed exclusively of Independent Directors. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

An Independent Director serves as Chairman of the Board of the SCB/Bernstein Funds. The Chairman's duties include setting the agenda for each Board meeting in consultation with management, presiding at each Board meeting, communicating with management between Board meetings, and facilitating communication and coordination between the Independent Directors and management. The Directors have determined that the Board's leadership by an Independent Director and its committees composed exclusively of Independent Directors is appropriate because they believe it sets the proper tone to the relationships between the applicable Fund, on the one hand, and the Adviser and other service providers, on the other, and facilitates the exercise of the Board's independent judgment in evaluating and managing the relationships. In addition, each Fund is required to have an Independent Director as Chairman pursuant to certain 2003 regulatory settlements involving the Adviser.

Risk Oversight.The Funds are subject to a number of risks, including investment, compliance and operational risks. Day-to-day risk management with respect to the Funds resides with the Adviser or other service providers (depending on the nature of the risk), subject to oversight by the Adviser. The Board has charged the Adviser and its affiliates with (i) identifying events or circumstances, the occurrence of which could have demonstrable and material adverse effects on the Funds; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to lessen the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of each Board's general oversight of each Fund's investment program and operations and is addressed as part of various regular Board and committee activities. Each Fund's investment management and business affairs are carried out by or through the Adviser and other service providers. Each of these persons has an independent interest in risk management but the policies and the methods by which one or more risk management functions are carried out may differ from the Funds' and each other's in the setting of priorities, the resources available or the effectiveness of relevant controls. Oversight of risk management is provided by each Board and the Audit Committee. The Directors regularly receive reports from, among others, management (including the Global Heads of Investment Risk and Trading Risk of the Adviser and representatives of various internal committees of the Adviser), each Fund's Chief Compliance Officer, each Fund's independent registered public accounting firm, the Adviser's internal legal counsel, and internal auditors for the Adviser, as appropriate, regarding risks faced by the Funds and the Adviser's risk management programs. In addition, the Directors receive regular updates on cyber-security matters.

| 7 |

Not all risks that may affect the Funds can be identified, nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost-effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of a Fund or the Adviser, its affiliates or other service providers. Because most of the Funds' operations are carried out by various service providers, including the Adviser, affiliates of the Adviser and third parties, the Board's oversight of the risk management processes of those service providers, including processes to address cybersecurity and other operational failures, is inherently limited. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve each Fund's goals. As a result of the foregoing and other factors the Funds' ability to manage risk is subject to substantial limitations.

Board Committees. The Board of the SCB/Bernstein Funds has four standing committees of the Board – an Audit Committee, a Governance Committee, a Fair Value Pricing Committee and an Independent Directors Committee. The members of the Audit Committee, the Governance Committee, the Fair Value Pricing Committee and the Independent Directors Committee are identified above.

The function of the Audit Committee is to assist the Board in its oversight of the applicable Fund's financial reporting process. The Audit Committee met three times during each Fund's most recently completed fiscal year.

The functions of the Governance Committee are to nominate persons to fill any vacancies or newly created positions on each Board, to monitor and evaluate industry and legal developments with respect to governance matters and to review and make recommendations to each Board regarding the compensation of Directors and the Chief Compliance Officer. The Governance Committee met five times during each Fund's most recently completed fiscal year, four of which were in conjunction with Board meetings.

The Governance Committee has a charter and, pursuant to the charter, the Governance Committee will consider candidates for nomination as a director submitted by a stockholder or group of stockholders who have beneficially owned at least 5% of a Fund's common stock or shares of beneficial interest for at least two years prior to the time of submission and who timely provide specified information about the candidates and the nominating stockholder or group. To be timely for consideration by the Governance Committee, the submission, including all required information, must be submitted in writing to the attention of the Secretary at the principal executive offices of a Fund not less than 120 days before the date of the proxy statement for the previous year's annual meeting of stockholders. If a Fund did not hold any annual meeting of stockholders in the previous year, the submission must be delivered or mailed and received within a reasonable amount of time before the Fund begins to print and mail its proxy materials. Public notice of an upcoming annual meeting of stockholders may be given in a stockholder report or other mailing to stockholders or by other means deemed by the Governance Committee or the Board to be reasonably calculated to inform stockholders.

| 8 |

Stockholders submitting a candidate for consideration by the Governance Committee must provide the following information to the Governance Committee: (i) a statement in writing setting forth (A) the name, date of birth, business address and residence address of the candidate; (B) any position or business relationship of the candidate, currently or within the preceding five years, with the stockholder or an associated person of the stockholder as defined below; (C) the class or series and number of all shares of the Fund owned of record or beneficially by the candidate; (D) any other information regarding the candidate that is required to be disclosed about a nominee in a proxy statement or other filing required to be made in connection with the solicitation of proxies for election of Directors pursuant to Section 20 of the 1940 Act and the rules and regulations promulgated thereunder; (E) whether the stockholder believes that the candidate is or will be an "interested person" of the Fund (as defined in the 1940 Act) and, if believed not to be an "interested person," information regarding the candidate that will be sufficient for the Fund to make such determination; and (F) information as to the candidate's knowledge of the investment company industry, experience as a director or senior officer of public companies, directorships on the boards of other registered investment companies and educational background; (ii) the written and signed consent of the candidate to be named as a nominee and to serve as a Director if elected; (iii) the written and signed agreement of the candidate to complete a directors' and officers' questionnaire if elected; (iv) the stockholder's consent to be named as such by the Fund; (v) the class or series and number of all shares of the Fund owned beneficially and of record by the stockholder and any associated person of the stockholder and the dates on which such shares were acquired, specifying the number of shares owned beneficially but not of record by each, and stating the names of each as they appear on the Fund's record books and the names of any nominee holders for each; and (vi) a description of all arrangements or understandings between the stockholder, the candidate and/or any other person or persons (including their names) pursuant to which the recommendation is being made by the stockholder. "Associated Person of the stockholder" means any person who is required to be identified under clause (vi) of this paragraph and any other person controlling, controlled by or under common control with, directly or indirectly, (a) the stockholder or (b) the associated person of the stockholder.

The Governance Committee may require the stockholder to furnish such other information as it may reasonably require or deem necessary to verify any information furnished pursuant to the nominating procedures described above or to determine the qualifications and eligibility of the candidate proposed by the stockholder to serve on the applicable Board. If the stockholder fails to provide such other information in writing within seven days of receipt of written request from the Governance Committee, the recommendation of such candidate as a nominee will be deemed not properly submitted for consideration, and will not be considered, by the Governance Committee.

The Governance Committee will consider only one candidate submitted by such a stockholder or group for nomination for election at an annual meeting of stockholders. The Governance Committee will not consider self-nominated candidates. The Governance Committee will consider and evaluate candidates submitted by stockholders on the basis of the same criteria as those used to consider and evaluate candidates submitted from other sources. These criteria include the candidate's relevant knowledge, experience, and expertise, the candidate's ability to carry out his or her duties in the best interests of the applicable Fund, and the candidate's ability to qualify as an Independent Director. When assessing a candidate for nomination, the Governance Committee considers whether the individual's background, skills, and experience will complement the background, skills, and experience of other nominees and will contribute to the diversity of each Board.

| 9 |

The function of the Fair Value Pricing Committee is to consider, in advance if possible, any fair valuation decision of the Adviser's Valuation Committee relating to a security held by the applicable Fund made under unique or highly unusual circumstances not previously addressed by the Valuation Committee that would result in a change in the Fund's NAV by more than $0.01 per share. The Fair Value Pricing Committee did not meet during each Fund's most recently completed fiscal year.

The function of the Independent Directors Committee is to consider and take action on matters that the Board or Committee believes should be addressed in executive session of the Independent Directors, such as review and approval of the Advisory and Distribution Services Agreements. The Independent Directors Committee met five times during each Fund's most recently completed fiscal year, four of which were in conjunction with Board meetings.

Meetings of the Governance Committee and the Independent Directors Committee may take place during executive sessions of Board meetings and may not be formally designated as Committee meetings.

The Board of the SCB/Bernstein Funds has adopted a process for stockholders to send communications to the Board.Board of their Fund. To communicate with the Board or an individual Director of a Fund, a stockholder must send a written communication to thethat Fund's principal office at the address listed in the Notice of AnnualJoint Meeting of StockholdersShareholders accompanying this Proxy Statement, addressed to the Board of that Fund or the individual Director. All stockholder communications received in accordance with this process will be forwarded to the Board or the individual Director to whom or to which the communication is addressed.

AMMAF

Experience, Qualifications, Attributes and Skills of the Director Nominees. The Governance and Nominating Committee (the "Nominating Committee") of AMMAF, which is comprised of Independent Directors, is responsible for reviewing the experience, qualifications, attributes and skills of potential candidates for nomination or election by the AMMAF Board, and conducted such a review in connection with the proposed nominees for election as Directors at the special meeting of stockholders (the "Director Nominees"). In evaluating a candidate for nomination or election, the Nominating Committee takes into account the contribution that the candidate would be expected to make to the diverse mix of experience, qualifications, attributes and skills that the Nominating Committee believes contributes to good governance for AMMAF. Each of the Director Nominees was recommended by the Adviser.

In considering the nomination of Director Nominees, the AMMAF Board considered the experience and backgrounds of the members of the Director Nominees, noting that the Bernstein Board (on which the Director Nominees serve) is comprised of a number of highly experienced and qualified individuals. The AMMAF Board noted that the Bernstein Board currently oversees 18 mutual fund portfolios with an aggregate net assets of approximately $37.7 billion as of June 30, 2018. The members of the Bernstein Board have served as such for an average of ten years, with the longest-serving director having served for 24 years. The AMMAF Board noted that the Bernstein Board is very familiar with the Adviser's private client business, including that Kathleen Fisher, an interested Director on the Bernstein Board, is the Head of Wealth and Investment Strategies for such business. The AMMAF Board also took into account the Adviser's representation that the transition of the AMMAF Board is not expected to have a material effect on the management and operations of AMMAF. The various employees of the Adviser who perform services for AMMAF (including the portfolio managers) are not expected to change; nor would AMMAF's various service providers, such as its custodian and administrator (State Street Bank and Trust Company), its transfer agent (AllianceBernstein Investor Services, Inc.) and its independent accountants (PricewaterhouseCoopers LLP).

| 10 |

The AMMAF Board believes that each Director Nominee's experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Director Nominees lead to the conclusion that each Director Nominee should serve as a Director. The AMMAF Board reviewed the background and experience of the Director Nominees and discussed their service as members of the Bernstein Board. The AMMAF Board discussed with the chairman of the Bernstein Board their process regarding oversight of service providers and their view of a board's role in risk management. In addition, one of the members of the AMMAF Board met with several other Director Nominees and discussed their service on the Bernstein Board and their potential service as Directors of AMMAF. The AMMAF Board noted the considerable knowledge of the Bernstein Board, its familiarity with the Adviser and the SCB Funds and its operations gained by each Director Nominee from his or her service as a member of the Bernstein Boards and their ability to efficiently oversee a diverse group of registered funds.

The AMMAF Board believes that, collectively, the Director Nominees have balanced and diverse experience, qualifications, attributes and skills, which will allow the Director Nominees to operate effectively in governing AMMAF and protecting the interests of stockholders. In determining whether a particular Director Nominee is qualified to serve as a Director, the Board considered a variety of criteria, none of which, in isolation, was controlling. In evaluating the Director Nominees, the AMMAF Board considered, among other things: Ms. Fisher has business, finance and investment management experience as Head of Wealth and Investment Strategies of Bernstein Private Wealth Management of AllianceBernstein L.P.; Mr. Friedman has a legal background and experience as a board member of various organizations; Mr. Gerken has investment management experience as a portfolio manager and executive officer, and experience as a board member; Mr. Kristol has a public and economic policy background and experience as a board member of various organizations; Ms. Perry has business and financial experience as a senior executive of various financial services firms focusing on fixed income research and capital markets and experience as a board member of various organizations; and Mr. Peterson has business and finance experience as an executive officer of public companies and experience as a board member of various organizations.

The AMMAF Board believes that the totality of the information it received regarding the Director Nominees supports the conclusion that each Director Nominee is qualified to serve as a Director of AMMAF. Based on these discussions, the Nominating and Governance Committee of AMMAF nominated each of the Director Nominees for election as Directors of AMMAF. The AMMAF Board recommends their election to stockholders of AMMAF. If elected, the Director Nominees will become Directors of AMMAF upon the resignation of the current AMMAF Board, expected to take place on (i) November 1, 2018, or (ii) December 11, 2018 (in the event of adjournment of the Meeting past November 1, 2018).

Current Board Structure and Oversight

The AMMAF Board is responsible for oversight of AMMAF and met in person or telephonically six times during the fiscal year ended March 31, 2018. The AMMAF Board has not adopted a specific policy regarding board members attendance at meetings of stockholders. Aside from the meeting of the initial stockholder at the inception of AMMAF, the Fund has not held any stockholder meetings.

| 11 |

The Fund has engaged the Adviser to manage the Fund's portfolio on a day-to-day basis. The AMMAF Board is responsible for overseeing the Adviser and AMMAF's other service providers in accordance with the AMMAF's investment objective and policies and otherwise in accordance with the requirements of the 1940 Act, and other applicable federal, state and other securities and other laws, and AMMAF's Declaration of Trust and Bylaws. The AMMAF Board meets in-person periodically throughout the year. The Independent Directors also regularly meet without the presence of any representatives of management. The AMMAF Board has established two standing committees — the Audit Committee and the Nominating Committee — and may establish ad hoc committees or working groups from time to time, to assist the AMMAF Board in fulfilling its oversight responsibilities.

Each committee is comprised exclusively of Independent Directors. The responsibilities of each committee, including its oversight responsibilities, are described further below. The Independent Directors have also engaged independent legal counsel, and may from time to time engage consultants and other advisors, to assist them in performing their oversight responsibilities.

An Independent Director serves as Chairman of the AMMAF Board. The Chairman's duties include setting the agenda for each AMMAF Board meeting in consultation with management, presiding at each AMMAF Board meeting, communicating with management between AMMAF Board meetings, and facilitating communication and coordination between the Independent Directors and management. The AMMAF Directors have determined that the AMMAF Board's leadership by an Independent Director and its committees comprised exclusively of Independent Directors is appropriate because they believe it sets the proper tone for the relationships between AMMAF, on the one hand, and the Adviser and other service providers, on the other, and facilitates the exercise of the AMMAF Board's independent judgment in evaluating and managing the relationships.

AMMAF is subject to a number of risks, including investment, compliance and operational risks. Day-to-day risk management with respect to AMMAF resides with the Adviser or other service providers (depending on the nature of the risk) subject to supervision by the Adviser. The AMMAF Board has charged the Adviser and its affiliates with (i) identifying events or circumstances, the occurrence of which could have demonstrable and material adverse effects on AMMAF; (ii) to the extent appropriate, reasonable or practicable, implementing processes and controls reasonably designed to reduce the possibility that such events or circumstances occur or to mitigate the effects of such events or circumstances if they do occur; and (iii) creating and maintaining a system designed to evaluate continuously, and to revise as appropriate, the processes and controls described in (i) and (ii) above.

Risk oversight forms part of the AMMAF Board's general oversight of the AMMAF's investment program and operations and is addressed as part of various regular Board and committee activities. AMMAF's investment management and business affairs are carried out by or through the Adviser and other service providers. Each of these persons has an independent interest in risk management but the policies and the methods by which one or more risk management functions are carried out may differ from AMMAF's and each other's in the setting of priorities, the resources available or the effectiveness of relevant controls. Oversight of risk management is provided by the AMMAF Board and the Audit Committee. The Directors expect to receive reports from, among others, management, the AMMAF's Chief Compliance Officer, the AMMAF's independent registered public accounting firm, and internal auditors for the Adviser, as appropriate, regarding risks faced by AMMAF and the Adviser's risk management programs.

| 12 |

Not all risks that may affect AMMAF can be identified, nor can controls be developed to eliminate or mitigate the occurrence or effects of certain risks. It may not be practical or cost-effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of AMMAF or the Adviser, its affiliates or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve AMMAF's goals. As a result of the foregoing and other factors AMMAF's ability to manage risk is subject to substantial limitations.

The AMMAF Board has two standing committees — an Audit Committee and the Nominating Committee. Each of the Committees is comprised solely of Independent Directors. Additional information about the committees is provided below.

Audit Committee. The principal responsibilities of the Audit Committee are oversight of AMMAF's financial reporting process and the appointment, compensation and oversight of AMMAF's independent registered public accounting firm. In this regard, the Audit Committee is responsible for meeting with the independent accountants and AMMAF's management to discuss the results of audits of AMMAF's financial statements and any matters of concern relating to such financial statements. The AMMAF Board has adopted a written charter for the Audit Committee. The Audit Committee held three meetings during the AMMAF's fiscal year ended March 31, 2018.

Nominating Committee. The principal functions of the Nominating Committee are to nominate persons to fill any vacancies or newly created positions on the AMMAF Board, to monitor and evaluate industry and legal developments with respect to governance matters and to review and make recommendations to the Board regarding the compensation of Directors. The AMMAF Board has adopted a written charter for the Nominating Committee.

While the Nominating Committee is solely responsible for the selection and nomination ofAMMAF's Independent Directors, the Nominating Committee may consider nominations for the office of director made by stockholders or by fund management, as it deems appropriate. Stockholders who wish to recommend a nominee should send to the Secretary of AMMAF a nomination submission that includes, among other matters set forth in AMMAF's Bylaws, all information relating to the recommended nominee that is required to be disclosed in a solicitation or proxy statement for the election of directors. Nomination submissions must be accompanied by a written consent of the recommended nominee to stand for election if nominated by the AMMAF Board and to serve if elected by stockholders. Except as may be provided in the Bylaws from time to time, the AMMAF Board has not adopted any specific minimum qualifications that the Nominating Committee believes must be met by a nominee for the board or any specific qualities or skills that are necessary for a nominee to possess. The Nominating Committee held one meeting during AMMAF's fiscal year ended March 31, 2018.

| 13 |